Australia’s property market is about to open its doors wider for first-home buyers.

From 1 October 2025, significant changes to the Home Guarantee Scheme will make it easier than ever to get into the market — and we’re now just two weeks away from those updates taking effect.

Here’s what you need to know to stay ahead.

What’s Changing?

The government is expanding the Home Guarantee Scheme with four major updates:

- Property Price Caps Are Increasing

In high-demand metro areas like Sydney, the new cap is rising from $900,000 to $1.5 million. That’s a $600,000 jump — giving buyers access to better homes in more suburbs. - 5% Deposit is All You Need

Eligible first-home buyers can purchase with just a 5% deposit, without paying lenders mortgage insurance (LMI) — potentially saving tens of thousands. - No More Income Caps

Previously, there were income thresholds. From October, higher earners can still access the Scheme — perfect for professionals who’ve been saving but just missed the income cut-off. - No Place Limits

All Australian first-home buyers can apply, whether you’re buying in the city or a regional area.

Where Can You Buy?

With the increased caps, buyers can now look at properties up to:

- $1.5 million in NSW metro and regional centres

- $950,000 in VIC

- $1 million in QLD and ACT

- $900,000 in SA

- $850,000 in WA

- $700,000 in TAS

- $600,000 in NT (unchanged)

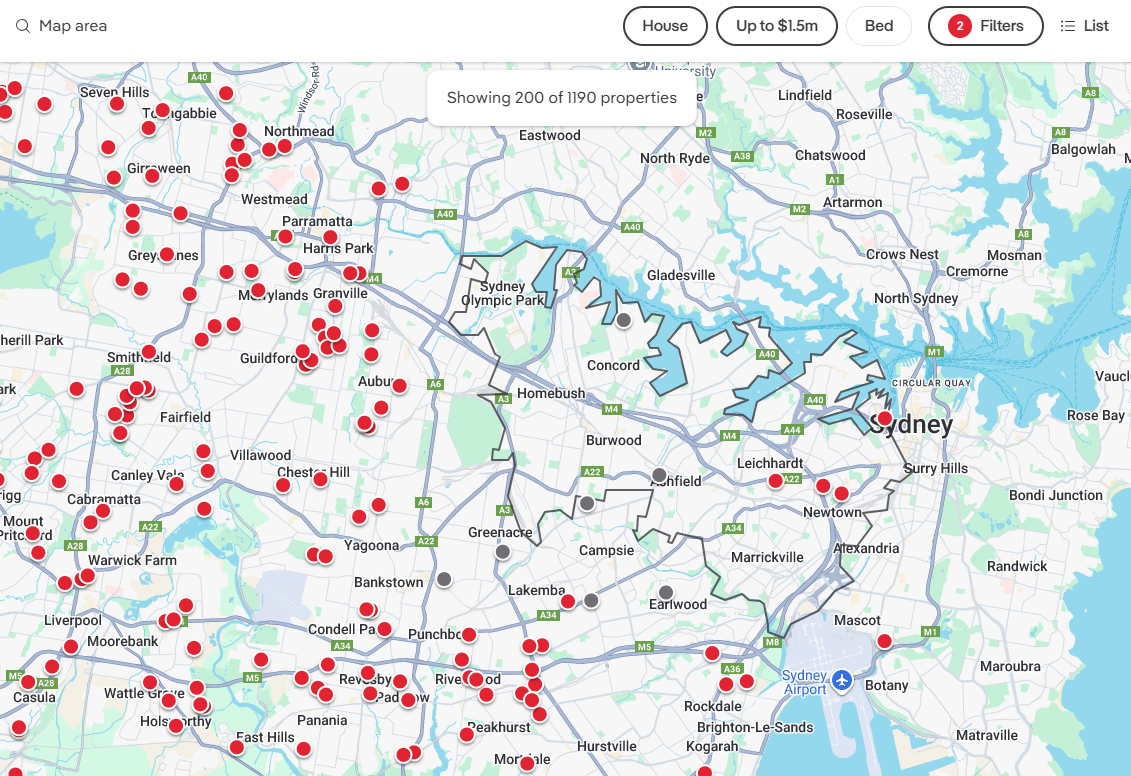

(Search realestate.com under $1.5M, houses, and use map view)

This means suburbs previously out of reach are now back on the radar — including family-friendly areas with access to transport, schools, and lifestyle amenities.

Who’s Eligible?

To qualify, you must:

- Be a first-home buyer who has never owned a property before

- Have saved a 5% deposit

- Be an Australian citizen or permanent resident

- Plan to live in the property as your principal place of residence

There are no income caps and no postcode restrictions from 1 October onward.

What Should You Do Now?

Don’t wait until October to get started — loan pre-approval, paperwork, and property search all take time.

Here’s your checklist:

- ✅ Book a free chat with a mortgage broker

- ✅ Know your borrowing capacity

- ✅ Get pre-approved for a loan

- ✅ Start searching for eligible properties under the new cap

- ✅ Be ready to make an offer once the changes kick in

At Loan Lounge, we’ll guide you through the whole journey — from pre-approval to settlement — and help you take full advantage of the Scheme.

📞 Ready to get started?

Book your free consultation via the link in bio or visit loanlounge.au

Let’s make your first home happen.