At Loan Lounge, one of the most common questions we hear is:

“Should I wait for interest rates to drop before buying a home?”

The answer depends on your goals, financial readiness, and where the market is heading. But with the current pace of property growth across Australia, waiting may actually cost you more—not less.

Let’s take a closer look.

The Market Is Accelerating—Fast

Australia’s property market has surged since early 2025. After only two months of price declines at the end of 2024, growth has rebounded sharply across both capital cities and regional areas.

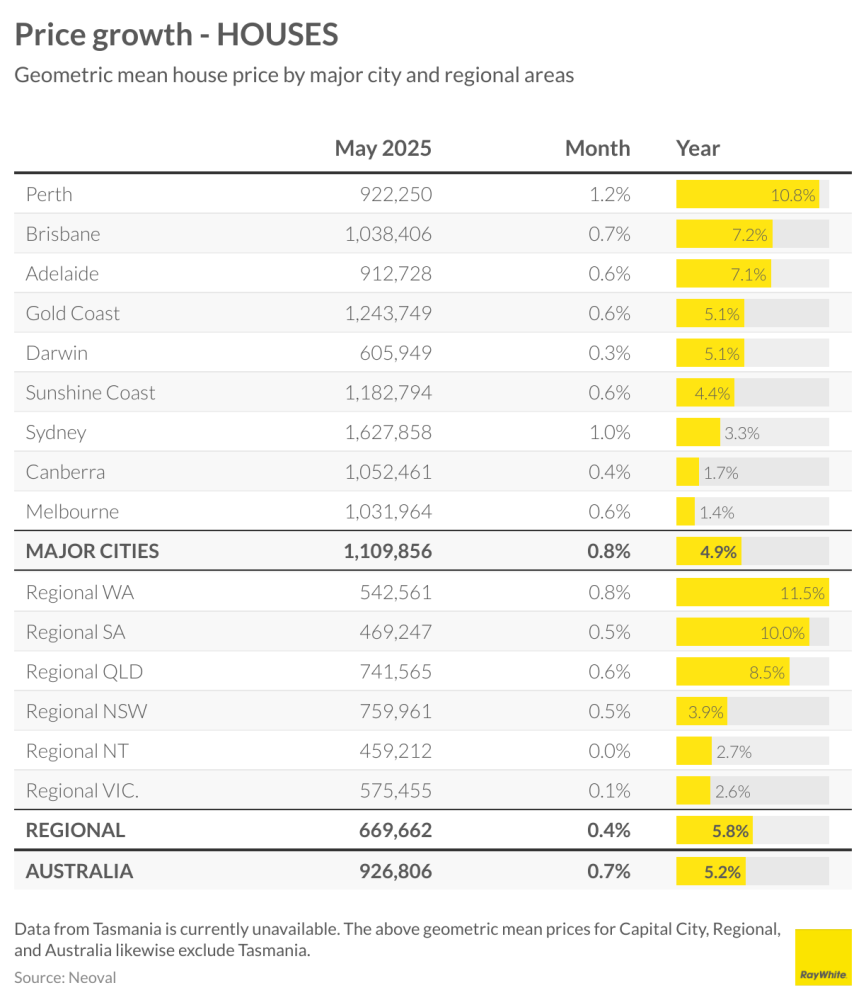

- National house prices have now reached a geometric mean of $926,806, with units averaging $687,144, according to Neoval data.

- Sydney houses now average $1.63 million, with economists forecasting a $2 million median by late 2026 if current growth continues.

- Perth and Adelaide are on track to cross the $1 million house median within the next 8 to 15 months.

- Regional WA and SA are showing some of the strongest year-on-year growth, at 5% and 10.0%, respectively.

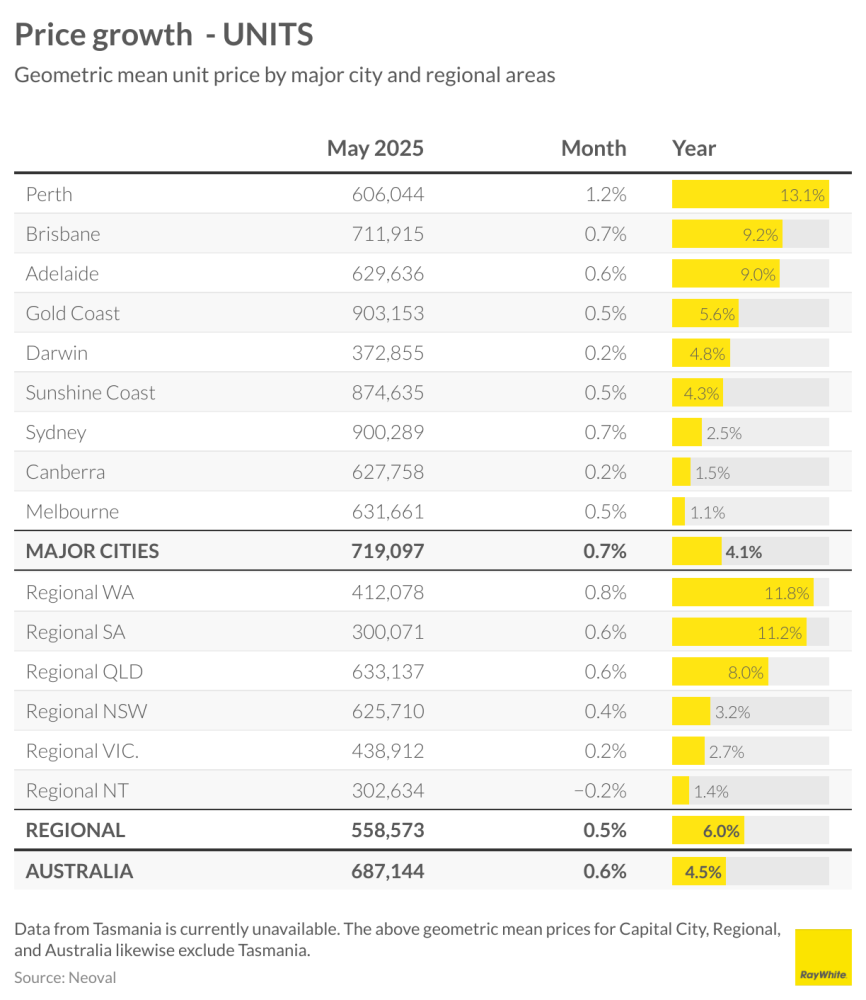

The unit market is also heating up, especially in more affordable cities:

- Perth units are up 1% annually

- Brisbane and Adelaide units have grown 2% and 9.0%, respectively

- Regional units show strong returns, with Regional WA up 8%

This widespread growth is being driven by limited housing supply, high construction costs, and strong demand.

View price growth charts: Ray White’s market data

What Happens If You Buy Now?

Advantages:

- Less competition in the current market

- Opportunity to lock in today’s price before further price hikes

- Ability to refinance when rates drop later

- Start building equity and owning your home sooner

Disadvantages:

- Interest rates are still relatively high

- You may qualify for a slightly smaller loan today than in a lower-rate environment

Use our Home Loan Borrowing Power Calculator to estimate your current position.

What Happens If You Wait?

Advantages:

- Potentially lower repayments with a future rate cut

- More time to save for a larger deposit

Disadvantages:

- Property prices are rising rapidly and may outpace rate relief

- More competition may re-enter the market when rates drop

- Delaying could cost you months (or even years) of equity growth

Can This Momentum Be Disrupted?

While current conditions support continued growth, there are risks that could slow momentum:

- Rising unemployment tied to global trade or economic shocks

- A delayed but eventual increase in housing supply

- New development projects being approved as profit margins rise

However, construction challenges—labour shortages, high material costs, and land scarcity—are not expected to resolve quickly. This means the supply-demand imbalance will likely continue to push prices upward over the next 12 to 24 months.

Are You Ready?

Instead of trying to time the market, ask yourself:

- Do I have a stable income?

- Have I saved enough for a deposit?

- Can I manage repayments comfortably, even at current rates?

Use our Repayments Calculator to explore different loan scenarios.

Still unsure? We’re here to help. Book a free, no-obligation chat with a Loan Lounge broker today.

Final Thoughts

There’s no perfect time to buy a home—but there is a smart time. If you’re financially ready, buying sooner may allow you to avoid future price surges and get ahead of the next market wave.

At Loan Lounge, we’ll help you navigate the process with clarity, purpose, and a plan.

Let’s make your move, smarter.